Legal Notice for Recovery of Dues From Employer

Date : 13 Mar, 2024

Post By admin

Written By : Advocate Hitesh Katharotiya | 18 years of experience | ★★★★★

In the realm of employment law, the issuance of a legal notice for the recovery of dues from an employer stands as a pivotal step towards maintaining financial integrity and upholding contractual obligations. This formal procedure not only signifies a commitment to resolving financial discrepancies but also underscores the importance of adhering to legal frameworks governing employer-employee relationships. By exploring the intricacies surrounding the drafting and delivery of such notices, individuals can equip themselves with the necessary tools to address labor disputes effectively. As we delve into the nuances of this process, a clearer understanding of the significance and procedural aspects of issuing a legal notice for the recovery of dues from an employer will come to light, shedding insight on the complexities inherent in employment law.

Understanding Legal Rights

Gathering Relevant Documentation

In preparation for pursuing legal action for the recovery of dues from an employer, the initial step involves meticulously gathering all relevant documentation pertaining to the outstanding payments. This is crucial to support your case and strengthen the legal notice or petition you intend to file. Here are four essential documents to gather:

- Employment Contract: Provide a copy of your employment contract to establish the terms of your employment, including salary details and any clauses related to dues upon termination.

- Pay Stubs and Bank Statements: Include copies of your pay stubs and bank statements showing the payment history and any discrepancies in the dues owed to you.

- Correspondence: Compile any emails, letters, or messages exchanged with the employer regarding the outstanding dues to demonstrate your attempts to resolve the matter informally.

- Termination Letter: If applicable, include the termination letter to validate the end of your employment and any dues mentioned in it.

Identifying Unpaid Dues

After meticulously gathering all relevant documentation, the next step in the process involves scrutinizing the records to identify any outstanding dues owed to you by the employer. This crucial phase requires a thorough examination of payment records, contracts, agreements, and any communication that may indicate pending payments. Look for any discrepancies or missing payments that are rightfully due to you. Identifying these unpaid dues accurately is essential for the subsequent legal proceedings.

To identify unpaid dues effectively, create a detailed list specifying each debt owed by the employer. Clearly outline the nature of the debt, the amount owed, the dates when the payments were due, and any relevant terms and conditions agreed upon. By organizing this information systematically, you not only establish a clear picture of the outstanding dues but also provide a solid foundation for drafting the legal notice for recovery. Ensuring that no dues are overlooked during this process is crucial for a successful recovery of unpaid amounts from the employer.

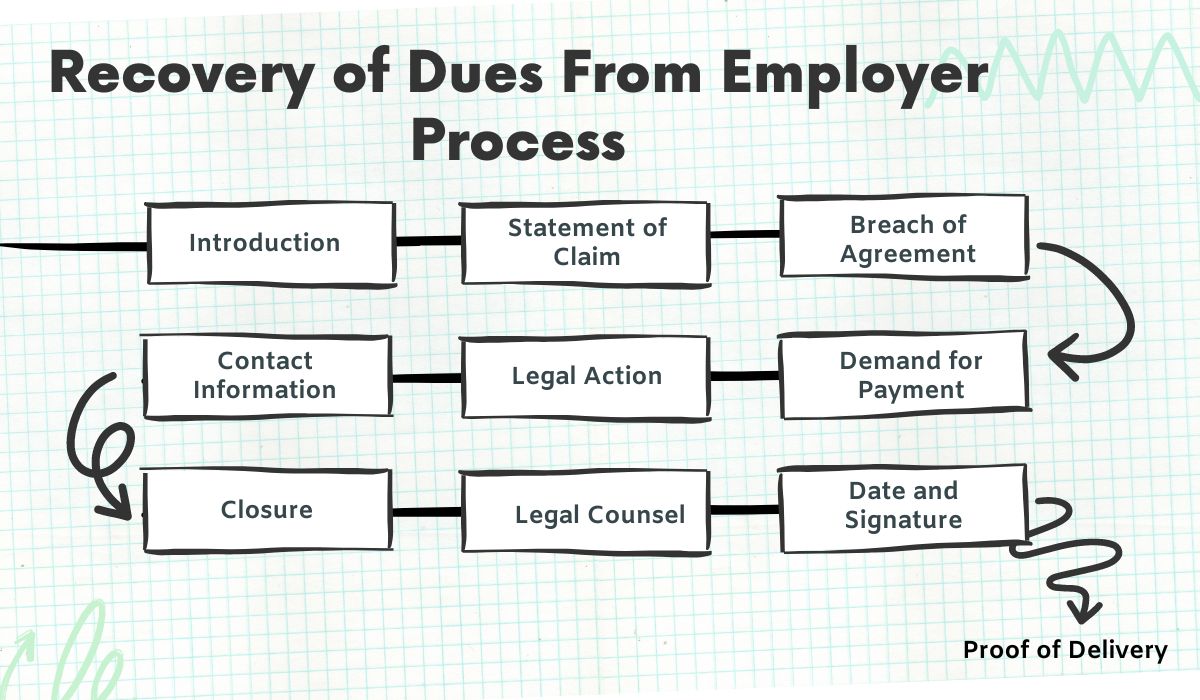

Drafting the Legal Notice

Upon meticulously compiling the details of the outstanding dues owed by the employer, the next imperative step is to craft a comprehensive Legal Notice for Recovery of Dues. When drafting the legal notice, ensure it includes the following essential components:

- Clear Identification: Clearly state the details of the outstanding dues, including the amount owed, the period for which it is due, and any relevant invoices or agreements.

- Legal Recourse Mention: Include a reference to the legal actions that may be taken if the dues are not settled promptly, emphasizing the seriousness of the matter.

- Deadline for Payment: Specify a reasonable deadline by which the payment must be made to avoid further legal action, clearly outlining the consequences of failing to meet the deadline.

- Signature and Delivery: Sign the legal notice, either personally or through legal representation, and ensure it is delivered to the employer through a reliable method to confirm receipt.

Drafting the legal notice meticulously is crucial as it serves as a formal communication initiating the process of debt recovery, setting the tone for further actions in case of non-compliance.

Including Essential Details

Having meticulously outlined the components crucial for drafting a comprehensive Legal Notice for Recovery of Dues from the employer, the next step is to ensure the inclusion of essential details to strengthen the legal stance of the notice. When preparing the legal notice, it is imperative to include specific information such as the total amount of dues owed, the timeline within which the payment must be made, a detailed account of the services or goods provided that led to the accumulation of the dues, and any relevant terms and conditions agreed upon between the employer and the employee. Additionally, it is essential to mention the consequences of non-payment, which may include legal action such as filing a lawsuit to recover the money owed. The notice should also reference any relevant laws or regulations that support the claim for recovery of dues. By including these essential details in the legal notice, the employer is provided with a clear understanding of the situation, their obligations, and the potential consequences of failing to address the outstanding dues promptly.

Sending the Notice

To initiate the legal process effectively, the legal notice for recovery of dues from the employer must be promptly sent via certified mail or hand-delivered to ensure proper documentation and acknowledgment. Sending the notice in the correct format and following the procedure is crucial to the success of the recovery process. Here are some key points to consider when sending the legal notice:

- Addressing the Employer: Ensure the notice is addressed correctly to the employer or their legal representative.

- Clarity and Conciseness: The notice should clearly state the details of the dues owed, including the amount, nature of the dues, and any relevant dates or agreements.

- Deadline for Response: Specify a reasonable deadline for the employer to respond or settle the dues to avoid unnecessary delays.

- Legal Assistance: Consider seeking legal advice or assistance to draft and send the notice professionally, ensuring all legal requirements are met.

Follow-Up Procedures

After sending the legal notice for recovery of dues from the employer, it is essential to establish a structured plan for follow-up procedures to ensure timely and effective resolution of the outstanding dues.

Key Steps in Follow-Up Procedures:

-

Clear Documentation: Maintain clear documentation of all communications and responses from the employer regarding the legal notice.

-

Response Assessment: If the employer fails to respond or disputes the debt, seeking legal advice from a lawyer experienced in debt recovery is crucial.

-

Legal Guidance: The lawyer can provide guidance on further legal actions that can be taken under the insolvency and bankruptcy code to recover the dues.

-

Insolvency/Bankruptcy Proceedings: Stay informed about insolvency or bankruptcy proceedings if the employer is facing financial difficulties.

-

Communication with Authorities: Regular communication with the insolvency resolution professional or the official liquidator can help in understanding the status of the dues and available options for recovery.

-

Timely Follow-Up: Timely follow-up and cooperation with legal counsel are key to navigating through the complexities of debt recovery from an employer.

By following these structured follow-up procedures, individuals can maximize their chances of recovering outstanding dues from the employer in a timely and efficient manner.

Seeking Legal Advice

How can one effectively navigate the complexities of seeking legal advice when pursuing recovery of dues from an employer? Seeking legal advice in matters of dues recovery from an employer is crucial to ensure a smooth legal process. Here are some key steps to consider:

- Assess Your Situation: Evaluate the details of your case, including employment contracts, payment records, and communication with the employer regarding dues.

- Research Potential Lawyers: Look for lawyers specializing in employment law and recovery of dues cases. Consider their experience, success rate, and client reviews.

- Schedule Consultations: Arrange consultations with selected lawyers to discuss your case. Use this opportunity to assess their understanding of your situation and their proposed strategies.

- Consider Legal Action: Based on the advice received, decide whether to proceed with legal action such as sending a legal notice for dues recovery or filing a lawsuit against the employer.

Seeking legal advice is a vital step in ensuring your rights are protected when pursuing recovery of dues from an employer. Consultation with a knowledgeable lawyer can provide clarity on the legal options available to you.

Resolving Disputes Amicably

Efficiently resolving disputes amicably is a fundamental aspect of maintaining professional relationships in matters of recovering dues from an employer. When faced with disputes regarding dues recovery, it is crucial to explore amicable solutions before escalating the matter further. Utilizing methods such as negotiation and mediation can often lead to swifter resolutions and help preserve the working relationship between the parties involved. Engaging a mediator to facilitate discussions and aid in finding common ground can be particularly beneficial in resolving disputes without resorting to legal actions like a civil suit.

Employers and employees are encouraged to consider alternate dispute resolution mechanisms to reach mutually agreeable solutions while avoiding the time-consuming and adversarial nature of a civil suit. By approaching disputes amicably and with a willingness to find compromise, both parties demonstrate a commitment to resolving issues in a professional and constructive manner. This not only expedites the recovery of dues but also fosters a positive environment for future interactions between the employer and the employee.

Taking Further Legal Action

When amicable resolutions fail to yield a satisfactory outcome in the recovery of dues from an employer, the aggrieved party may need to consider escalating the matter through legal channels by contemplating the formulation and issuance of a formal legal notice. This step marks the initiation of further legal action in the pursuit of recovering the outstanding dues. To navigate this process effectively, the following steps are crucial:

- Consultation with Legal Counsel: Seek advice from a legal professional specializing in employment and contract law to understand the viability of your case.

- Drafting a Comprehensive Legal Notice: Ensure the legal notice clearly states the outstanding dues, relevant contractual obligations, and the intention to pursue legal action if the dues are not settled promptly.

- Sending the Legal Notice: Dispatch the legal notice through appropriate channels with proof of delivery to the employer, highlighting the seriousness of the matter.

- Preparing for Litigation: If the employer fails to respond or disputes the claim, prepare to initiate formal legal proceedings through the appropriate civil procedure to recover the dues owed.

Conclusion

In conclusion, issuing a legal notice for the recovery of dues from an employer is a crucial step in upholding the rights of employees and ensuring compliance with legal obligations. By following the procedural aspects outlined in this article, individuals can navigate labor disputes effectively and seek resolution through legal means. It is essential to prioritize transparency, accountability, and adherence to legal protocols when addressing financial discrepancies in the realm of employment law.

Frequently Asked Questions

Q1. Can a Legal Notice for Recovery of Dues From an Employer Be Sent via Email or Does It Have to Be Sent via Registered Mail?

Ans. A legal notice for recovery of dues from an employer can be sent via email or registered mail. However, using registered mail provides a formal record of delivery, which can be important if the matter escalates legally.

Q2. Is There a Specific Time Frame Within Which the Employer Is Required to Respond to the Legal Notice?

Ans. In response to a legal notice for recovery of dues, the employer is typically required to respond within a reasonable time frame, which can vary depending on the specific circumstances and jurisdiction. It is advisable to consult legal counsel for guidance on this matter.

Q3. What Are the Potential Consequences if the Employer Refuses to Pay the Dues Even After Receiving the Legal Notice?

Ans. If the employer refuses to pay dues despite receiving a legal notice, potential consequences may include legal action such as filing a lawsuit, seeking court intervention, or involving relevant labor authorities to enforce payment obligations.

Q4. Can the Legal Notice Include a Deadline for Payment, and What Are the Implications if the Deadline Is Not Met?

Ans. Yes, a legal notice can include a deadline for payment. If the deadline is not met, the sender can pursue legal action, such as filing a lawsuit, seeking court intervention, or engaging in debt recovery procedures to enforce the claim.

Q5. Are There Any Specific Laws or Regulations That Govern the Process of Recovering Dues From an Employer Through a Legal Notice?

Ans. Specific laws and regulations govern the process of recovering dues from an employer through a legal notice. Understanding these legal frameworks is crucial for ensuring compliance and effectively pursuing the recovery of owed dues.